la city business tax rates|Los Angeles City Business Tax annual filing due February 28, 2022 : Tuguegarao Please click on the following link to discover the applicable tax rate for your business type. Interest Rates Tingnan ang higit pa direct hiring, pogo hiring. part time work from home. Return to Search Result Job Post Details. Online Casino Dealer - job post. Posche Promotions a/k/a Posche Models. Makati. PHP 65,000 - PHP 85,000 a month. Apply now. Job details Here’s how the job details align with your profile. Pay.

PH0 · Tax Information Booklet

PH1 · Online Taxpayer Services

PH2 · Los Angeles City Business Tax: What You Need To Know

PH3 · Los Angeles City Business Tax: What You Need To

PH4 · Los Angeles City Business Tax annual filing due February 28, 2022

PH5 · Los Angeles City Business Tax annual filing due February 28,

PH6 · Know Your Rates

PH7 · City of Los Angeles Business Tax Subsidy for Internet

PH8 · City of Los Angeles

PH9 · Annual Business Taxes

PH10 · About the Business Tax

Watch pinay bisaya scandal porn videos. Explore tons of XXX movies with sex scenes in 2024 on xHamster!

la city business tax rates*******While there are many different business activities taxed at varying rates, the following represent the most common business types. Tingnan ang higit pa

Please click on the following link to discover the applicable tax rate for your business type. Interest Rates Tingnan ang higit pala city business tax ratesPlease click on the following link to discover the applicable tax rate for your business type. Penalty Rates Tingnan ang higit paBusiness Taxes. About Back Taxes for New Business Activity; About the Business Tax; Fiscal vs. Calendar Year Reporting; Know Your Rates; Renewal Period FAQS; Tax .

How Taxes are Determined. Most business taxes are based on gross receipts. For those Business Tax Classifications, the tax rate is a specified amount per $1,000 of taxable .

The LACBT generally is imposed on all gross receipts of a taxpayer earned in the City at a rate between 0.1% to 6.0% based upon in-City business activities. The tax rate varies .Business Tax Rate Table 2009-Present. Note: L049 rates: 2018--$4.25. Note: L049 rates: 2017--$4.50. Note: L049 rates: 2016--$4.75. **Note: L149 Rates: 2012--$3.38; 2013--$1.69.

The tax rate is determined by a taxpayer’s business tax classification, with many taxpayers falling within the “professions and occupations” category, which has a rate of 0.425% for the 2023 filing. The “professions and .Business Taxes. About Back Taxes for New Business Activity; About the Business Tax; Fiscal vs. Calendar Year Reporting; Know Your Rates; Renewal Period FAQS; Tax .The City of Los Angeles offers a reduced tax rate of $1.01 for every $1,000 in gross receipts for internet-based businesses.Subtract $25,000 from the amount on line 12 and put this amount in box 13a. Multiply the amount in box 13a by 10% (0.1) and put this amount in box 13b. Add $25,000 to box 13b and put the total in box 14. Line 15 – .

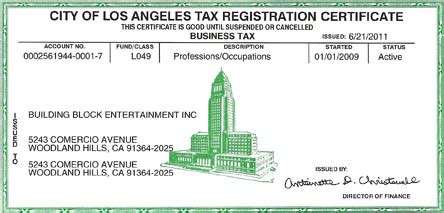

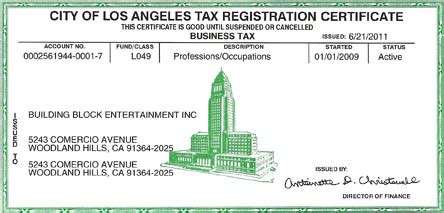

The 2022 Business Tax Renewal Form, based upon 2021 activity for calendar-year taxpayers, must be filed on or before February 28, 2022. Taxpayers conducting business in Los Angeles, as well as in neighboring cities, may be subject to the annual LABT with a filing deadline of February 28, 2022.Step 2: Business Tax Registration Certificate. Once you've completed your application, you will be able to obtain your Business Tax Registration Certificate (BTRC). If you completed your application online, you will be issued a temporary BTRC that you may print and display at your business. Your permanent Certificate should arrive in the mail .

The purpose of the fund/class consolidation is to simplify business tax compliance by reducing the number of fund/classes that businesses subject to the City of Los Angeles’ gross receipts tax are required to report under. Ordinance #183419 consolidates LAMC Section 21.42 into Section 21.41, and LAMC Sections 21.44 and 21.45 into Section 21.43.la city business tax rates Los Angeles City Business Tax annual filing due February 28, 2022 2. Your business address street number 3. Your business address zip code. An instructional walk through of the e-filing process can be found here. Important System Information: • eFiling is only available to businesses that are currently registered. If you are a new business, you must obtain an Application for a Business Tax Registration . Doing Business with CDTFA; Jobs with CDTFA; Sign Up for Updates; California City & County Sales & Use Tax Rates (effective April 1, 2024) These rates may be outdated. For a list of your current and historical rates, . Los Angeles: City: Wildomar: 8.750%: Riverside: City: Williams: 8.250%: Colusa: City: Willits: 9.125%: Mendocino: .

The City of Los Angeles reduced the rate for the classification of major business taxes. The commercial tax rate for fund/class L049, including Careers and Professions, will be gradually reduced by three annual tax periods beginning on January 1, 2016 as follows: • On January 1, 2016 it decreased from $ 5.07 for $ 1,000 of gross .

Watch on. The first year of new business activity in the City of Los Angeles is not exempt from taxation. The first year of taxes is paid in the second year when you renew your BTRC. This is referred to as the BACK TAX. When a new business activity subject to tax is started, it is required that the minimum tax be paid with the application.The 2023 Business Tax Renewal Form, based upon 2022 activity for calendar-year taxpayers, must be filed on or before February 28, 2023. Taxpayers conducting business in the City of Los Angeles, as well as in neighboring cities, may be subject to the annual LACBT with a filing deadline of February 28, 2023.3: Tax Rate Amount for L188. 4: Take the result from Line 2 and round up total gross receipts to the next highest $1,000 and enter the result here. For example $537,461 rounded up is $538. Multiply Line 4 by Line 3, and enter the result here, and if Col. G is blank on the Business Tax.City of Los Angeles Non-Gross Receipts Business Tax Rate Table Fund/Class Description Type of Tax Base Minimum Tax Tax Rate per add’l Unit/ $1,000 Payment Frequency LAMC Code Section L053 Amusement Park flat $923.83 Quarterly 21.53 L055 Auctioneer flat $886.88 Annual 21.55 L062 Billiards table $106.43 $106.43/ Table Annual .ACap Advisors & Accountants is a “Fee-Only” wealth management and full-service accounting firm headquartered in Los Angeles, CA specializing in helping doctors and healthcare professionals make sound financial .Los Angeles City Business Tax annual filing due February 28, 2022 3rd Month. 15%. 4th Month. 20%. 5th Month and beyond. 40%. Note: After the 5th month, the penalty rate will have reached the maximum rate of 40%. For 2001 and prior years, the penalty rate was 20% as soon as the taxes were delinquent. Also for those businesses more than four months delinquent, an additional 20% penalty is imposed for a total .

Monthly Business Tax/Class associated with the DCR Permit Fund/Class. Tax Rate. Sales and delivery of medical use cannabis and cannabis products. J010 - Retail Storefront. . The Office of Finance has three locations across the City of Los Angeles to best service your needs as well as a new virtual public counter.The City of Los Angeles Office of Finance administers the city's business tax, as well as several of the permit renewals that are required for business owners. The key dates are below: February 28 (Feb 29 if Leap Year): All business entities must pay a city business tax each year, or file for an exemption. Business taxes are due on January 1st .Interest is due on delinquent business tax and is also payable on business tax refunds. Additional interest accrues with each month in delinquency. . The interest rate is re-calculated annually to reflect the average Federal short-term rate plus 3 percentage points. Tax Year Monthly Interest Rate; 2024: 0.7%: 2023: 0.5%: 2022: 0.3%: 2021: 0.5 .City of Los Angeles Non-Gross Receipts Business Tax Rate Table Fund/Class Description Type of Tax Base Minimum Tax Tax Rate per add’l Unit/ $1,000 Payment Frequency LAMC Code Section L053 Amusement Park flat $923.83 Quarterly 21.53 L055 Auctioneer flat $886.88 Annual 21.55 L062 Billiards table $106.43 $106.43/ Table Annual .Under LAMC Section 21.43, renting dwelling units is a business activity and is subject to a City of Los Angeles business tax. Under, LAMC Section 21.03 , no person shall " . Under LAMC Section 21.43(LGR2), the rate is $1.27 per $1000.00 or fractional part there of. The annual tax renewal is due on the first date of January of each calendar year.

Get £60 In Free Bets When You Deposit & Bet £10 T&Cs apply. 18+. Play Safe. New players only, using promo code T60. Valid from 13/04/2022. Online play. Get £60 Bonus split between Vegas & Sports in the following manner – (i) Deposit £10 to unlock £20 Vegas Free Bet on Selected Games (72hr expiry, wagering reqs apply); then (ii) bet £10+ .

la city business tax rates|Los Angeles City Business Tax annual filing due February 28, 2022